tala loan application form|Iba pa : Clark Tala: Fast Cash Peso Loan App. Tala Mobile. 4.7star. 689K reviews. 10M+. Downloads. Rated for 3+. info. Install. Share. Add to wishlist. About this app.

Caution: When navigating mail storage locations, careful not to confuse the Online Archive folder with your existing Archive mail folder.For example, Move to Archive action in the ribbon, places the selected item into your local Archive, not the Online Archive.

PH0 · tala.com loan

PH1 · tala kenya app

PH2 · free loan application template

PH3 · Iba pa

Ang Pagtulong sa Nangangailangan - Mag-ingat kayo na huwag gawing pakitang-tao lamang ang inyong pamamahagi sa mga kahabag-habag. Kung magkagayon ay hindi kayo tatanggap ng gantimpala sa inyong Ama sa langit. Kaya nga, kapag ikaw ay namamahagi sa mga kahabag-habag, huwag mong hipan ang trumpeta na nasa harap mo, gaya ng .

tala loan application form*******Does Tala have a loan application form online? No. The Tala loan application process can only be accessed from within the app. We currently do not have online application .Gain access to a fast, flexible, and secure way to borrow up to PHP 25,000 with .

Download and apply. Buo ang Tiwala. Join over 8 million global customers who .tala loan application form Iba pa Step 1: Using your Android smartphone (OS4 and up), open Google Play Store to download Tala or you may also click this link. Step 2: Sign up for a Tala .Application process. How do I apply for a Tala loan? (New customers) Where can I download the Tala loan app? How do I apply for a Tala loan? (Current or previous .Tala: Fast Cash Peso Loan App. Tala Mobile. 4.7star. 689K reviews. 10M+. Downloads. Rated for 3+. info. Install. Share. Add to wishlist. About this app.Step 1: Gamit ang iyong Android smartphone (OS4 and up), buksan ang Google Play Store para ma-download ang Tala or maaari mo rin i-click ang link na ito. Step 2: Mag-sign up . Apply in 5 mins. Fast money & safe pesa loan app. Instant cash sent to M-Pesa.

Application process. How do I apply for a Tala loan in Philippines? (Current or previous customers) Once you have settled your loan repayment, you may reapply for .

To apply for a Tala loan, you must first download the app and apply from within the app. To download the app, please visit your country's official site: Tala Loan . This is a questionnaire they use to know more about your usage and what you plan to do with the loan. This is the only Tala loan application form you will find; any other you can find online is fake, and you can avoid it. Tala uses this information to grant your loan, and I will give an overview of all the questions asked on the Tala loan app.How do I apply for a Tala loan? (New customers) Where can I download the Tala loan app? How do I apply for a Tala loan? (Current or previous customers) How fast can I get a Tala loan? What kinds of fees and interest does Tala charge? How long do I have to repay Tala? Can I top up my loan, or get another loan when I have a pending one?

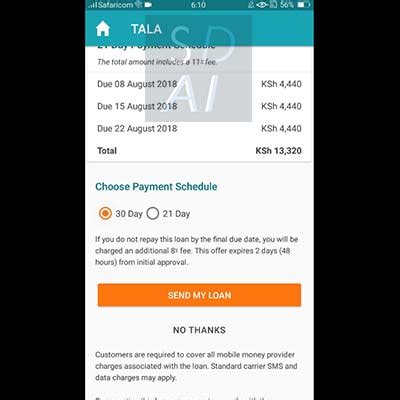

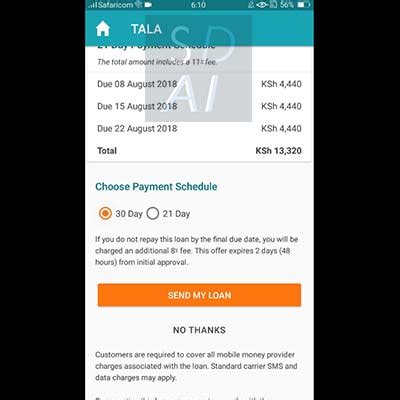

The lender charges a one-time processing fee for each offer. It may be 11% for 21-day loans and 15% for 30-day loans. Thus, Tala online loan calculator shows that for the amount of P1,000 taken for 30 days, the fee .Instant Loans up to ₹10,000 in 5 mins! Trusted by 70+ lakh customers worldwide, the Tala online loan app offers fast growing instant personal loans up to ₹10,000. No salary slip, bank statement or credit score needed. Alert: Tala is currently not accepting any loan applications from new customers, as we are working on important updates.

Tala Loan Application Guide in the Philippines. Tala loan application is quick and easy with the Tala mobile app. It takes only a few minutes to register for an account, accomplish a Tala loan application form, and verify your identity. Tala Loan Application Process. Download the Tala Philippines app [2] on Google Play Store.

Unlike other traditional online loan or cash loan apps, Tala is not a loan app but an enhanced credit experience with continuous always-on credit available to users with a good payment history. . We provide continuous cash access to consumers in the form of a personal credit line. Tala is not associated with loan apps in the Philippines such .tala loan application formUnlike other traditional online loan or cash loan apps, Tala is not a loan app but an enhanced credit experience with continuous always-on credit available to users with a good payment history. . We provide continuous cash access to consumers in the form of a personal credit line. Tala is not associated with loan apps in the Philippines such . Tala Loan App download. Here is a step by step guide to for Tala loan app download. To download Tala Apk, All you need is a registered Mpesa line and a mobile phone. It doesn’t matter if it is a smartphone or feature phone, whether you run android or Microsft enabled devices. You can get Tala Loans straight to your M-Pesa.

Provide accurate answers to the questions asked when completing the Tala loan application form. Remember that your creditworthiness will be determined based on the accuracy of the information that you provide. Enter the loan amount and choose the repayment period of either 21 days or 30 days. Remember, the interest rate for the .Iba pa Before diving into the Tala loan application form, let's first glimpse what Tala represents in the Kenyan financial landscape. For nearly a decade, Tala has stood as a beacon of financial hope for millions in Kenya, offering a digital lending hand to those in urgent need of funds. More than just a loan provider, this service has become a vital .Tala loan app allows you to borrow up to 10,000 pesos. If you need money fast, you can use the Tala loan app. Its user-friendly app lets you apply for a loan in just five minutes. The loan is approved within 60 days. Unlike other loan apps, you can pay the amount back in cash or with a bank card. The Tala loan application process is simple like this: Step 1: Download Tala App. Visit the Google Play Store and download the app to your phone. To complete this task, you must be connected to the internet and have an M-Pesa-activated phone number. Step 2: Fill Tala loan application form. The next step is for you to sign up in .

Open the Tala Philippines App. Tap Apply button. Read the Tala application steps and tap Get Started to start the application. Fill the loan application form. Check interest rates. Check if your application is approved by tapping ViewLoan Offer. Check approved loan. Choose a repayment date if your loan is approved.Please send us your questions, comments, thoughts, or complaints through this form and our support team. will respond as soon as possible. Click here. For business-related inquires, please email us here. Contact Tala customer service via email at [email protected] or message us directly from the app. For payment support email [email protected] Tala Limit is the maximum amount that you can cash out.. For example: If you have been approved for P2,000 on your first Tala application, your Tala limit is P2,000. You can choose to withdraw a partial amount or the full amount depending on your needs. Access to a credit line simply means that you have repeat access to cash from Tala. This allows .

Unlike other traditional online loan or cash loan apps, Tala is not a loan app but an enhanced credit experience with continuous always-on credit available to users with a good payment history. . We provide continuous cash access to consumers in the form of a personal credit line. Tala is not associated with loan apps in the Philippines such .

Steps on how to apply for a loan on Tala Mobile App. Step 1: Open the Tala App. Step 2: Select ‘your language:’ either Swahili or English. Step 3: Select either ‘I’M New’ – ‘Create account’ or ‘Sign In’. Step 4: Enter your ‘M-Pesa number’. Step 5: Enter ‘PIN’ for your number. Step 6: Wait for the main Tala Mobile App . Tala apps loan uses alternative data and machine learning algorithms to assess the customer’s creditworthiness and determine their eligibility for a loan. If the customer’s Tala loan application is approved, the funds are disbursed directly to their mobile wallet, and they can use the money for any purpose, such as paying bills, . The entire loan application process happens in the Tala loan app, which can be downloaded from the Google Play Store. Eligible applicants are asked to fill out an online form and answer some questions that will give Tala an idea of the financial capacity of the borrower.

I just recently transferred to qc for college and I want to have my bike (from davao) shipped here. Ano po kaya safe & affordable options for this?.

tala loan application form|Iba pa